Volatility will be with us again . Expect another massive gap lower than, in part, to Apple (AAPL).

The much-loved AAPL delivered a dismal earnings outlook, reinforcing the worries over a slowdown in consumer spending. AAPL is down with 11 percent in pre-market trading.

Emotions will run high again today and we’re likely to see some more wild swings in the broader market, so we’re looking at a couple of patterns off the beaten path.

FXE – Double Top

We’re watching the unfolding of a potential double top in the Euro Currency Shares Trust (FXE). This ETF tracks the EUR/USD exchange rate.

The FXE reveals that the dollar is weakening when it’s trending up and , the dollaris strengthening when it’s trending down.

lot of people do not expect the dollar to be strenghthen . But in our view, that’s all the more reason to watch for a bullish reversal in the greenback vis-à-vis a breakdown in the FXE.

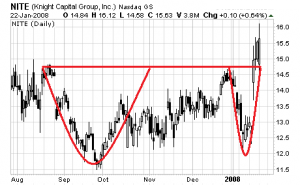

NITE – 123 Bottom

Shares of Knight Capital Group (NITE) are holding up remarkably well in this market climate. The stock started to come in action back in October. NITE has since traced a higher relative low and broke above horizontal resistance at $14.75,completing a 123 bottom. Look for the stock to hold above resistance, which should now serve as support.