Application of Average True Range

The Average True Range does not usually consider the direction of progress but it surely considers the degree of volatility However, even a small change in the level of Average True Range can provide important information regarding trading

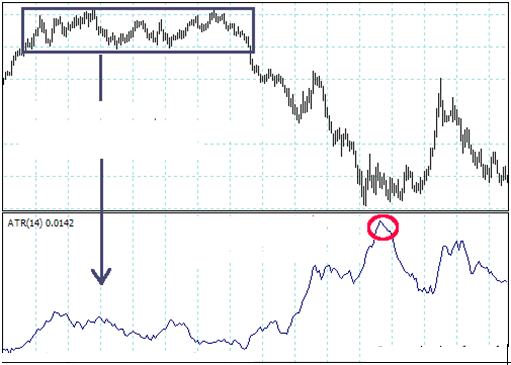

1) The peak of ATR is frequently at a peak or a trough.

2) The periods of low volatility often precede large movements in prices.

3) The course will move frequently within a horizontal range in the low values of the ATR.

Average True Range

Use of ATR for the Money Management

The ATR can successfully be used to determine the level of stop loss orders. You just need to take a multiple of the ATR and the removal or addition on the course. The multiple used depends on the following :

- An active trader

- The risk profile

- The capital.

Example of a multiple of 3:

Long GBP / USD at 1.6450 with an ATR 0.0014

3 * 0.0014 = 0.0042

1.6450 – 0.0042 = 1.6408 to stop at 42 pips

You can then determine the size of the position for the 42 pips do not exceed your maximum permitted level loss.