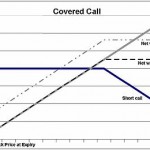

A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument, such as shares of a stock or other securities. An options strategy whereby an investor holds a long position in an asset and writes (sells) call options on that same asset in an attempt to generate increased income from the asset. This … [Read more...]

Short Put : Option Trading Explained

Writing a put obligates you to buy the underlying stock at the strike price any time until expiry if you are assigned. short put is created when long stock position is combined with a short call of the same series. It is so named because the established position has the same profit potential a short put. Limited Profit Potential The formula for calculating maximum profit … [Read more...]

Trading with Double Diagonal Options

A double diagonal trade is a neutral trade, with a small chance for profit and an equivalent small chance for loss. If you're familiar with options trades, the double diagonal is similar to a Butterfly spread except of that it is diagonal. The most challenging aspect of the trade is finding a good discount broker, since the trade requires four distinct transactions. Define a … [Read more...]

why trading plan is needed?

Trading plan in neccessary before you decide on winning the stock market. it's like trying to build a house without blueprints - costly mistakes are inevitable resulting in huge losses . Why do you need a Trading Plan? 1 - During the trading hours, emotions will turn smart people into idiots.while making trading plans and following it emotions should be kept at bay . … [Read more...]