A long straddle involves going long, i.e., purchasing, both a call option and a put option on some stock, interest rate, index or other underlying. The two options are bought at the same strike price and expire at the same time. The owner of a long straddle makes a profit if the underlying price moves a long way from the strike price, either above or below. Thus, an investor … [Read more...]

Put Bear Spread – Option Trading

Bear spread in which a put with a higher striking price is purchased and one with a lower striking price is sold, both options having the same expiration date. This spread is sometimes more broadly categorized as a "vertical spread": a family of spreads involving options of the same stock, same expiration month, but different strike prices. They can be created with either all … [Read more...]

Call Bearspread – Option Trading

A bear call spread is a limited profit, limited risk options trading strategy that can be used when the options trader is moderately bearish on the underlying security. It is entered by buying call options of a certain strike price and selling the same number of call options of lower strike price (in the money) on the same underlying security with the same expiration … [Read more...]

Put BackSpread Option- Explained

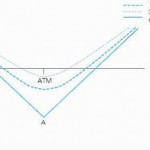

Put back spreads are great strategies when you are expecting big downward moves in already volatile stocks. The trade itself involves selling a put at a higher strike and buying a greater number of puts at a lower strike price. The put backspread is a strategy in options trading whereby the options trader writes a number of put options at a higher strike price (often … [Read more...]

Long Put Option- Explained

A put option (usually just called a "put") is a financial contract between two parties, the writer (seller) and the buyer of the option. The buyer acquires a short position with the right, but not the obligation, to sell the underlying instrument at an agreed-upon price (the strike price). If the buyer exercises his right to sell the option, the seller is obliged to buy it at … [Read more...]