ABC Agreement is an agreement between a firm that finances a seat on the New York Stock Exchange and the employee who purchases the seat. The agreement, approved by the exchange, permits the member to transfer the seat to another employee of the member firm, keep the seat and purchase a second membership for another individual designated by the lending firm, or sell the … [Read more...]

Multi Legged Option Trading Strategy Explained

A type of order that allows an option trader to simultaneously buy or sell a number of different options that traditionally could only be achieved by placing separate orders. An option is a contract that gives the owner the right to buy or sell a security at a specific price within a specific time limit. The owner of an option contract is not obligated to exercise the option … [Read more...]

The Long Gut – Option Trading

The Long Gut Spread is a volatile options trading strategy designed to profit when the underlying stock moves strongly upwards or downwards. The Long Gut Spread is a cousin of the Long Straddle and the Long Strangle with the only difference being that In The Money options are used instead.This strategy is usually used by traders who not sure as the direction of the underlying … [Read more...]

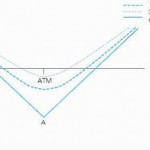

Long Straddle Option Trading Strategy

A long straddle involves going long, i.e., purchasing, both a call option and a put option on some stock, interest rate, index or other underlying. The two options are bought at the same strike price and expire at the same time. The owner of a long straddle makes a profit if the underlying price moves a long way from the strike price, either above or below. Thus, an investor … [Read more...]

Put BackSpread Option- Explained

Put back spreads are great strategies when you are expecting big downward moves in already volatile stocks. The trade itself involves selling a put at a higher strike and buying a greater number of puts at a lower strike price. The put backspread is a strategy in options trading whereby the options trader writes a number of put options at a higher strike price (often … [Read more...]