The Accumulation Swing Index helps showing the line of the real market. The Accumulative Swing Index uses a scale from 0 to 100 for an up trend and 0 to -100 for a down trend. The Swing Index was developed by Welles Wilder.

The ASI has a positive value if a long-term trend is up, and if long-term trend is down indicator appears in a negative value. During sideways moving market, the ASI moves between + and – values.

Interpretation :

ASI is able to show the real strength and direction of the market and since Accumulative Swing Index is heavily weighted in favor of the close price, daily upward and downward spikes do not adversely affect ASI.

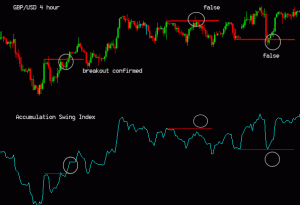

Accumulative Swing Index is widely used to confirm or deny trend lines breakouts on Forex charts. Trend lines are drawn on both: a chart and indicator’s graph and then compared against each other to confirm/dismiss trend line breakout signals.

Since ASI line represents real market price, traders may use the following points while trading :

– identify support/resistance levels

– trend lines and true market direction

– swings high/low

– breakout setups

– and divergence between indicator and regular price charts.

Formula :

ASI = 50 * (Cy – C + 0.5 (Cy-Oy) + 2.5 (C – O)) / R * K/T

Where:

C = Today’s closing price

Cy = Yesterday’s closing price

Hy = Yesterday’s highest price

K = The greatest of: Hy – C and Ly – C

L = Today’s lowest price

Ly = Yesterday’s lowest price

O = Today’s opening price

Oy = Yesterday’s opening price

R = This varies based on relationship between today’s closing price and yesterday’s high and low prices

T = the maximum price changing during trade session

how to draw on chart find the movement of market

i m aintraday only nofty player