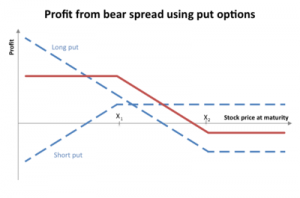

Bear spread in which a put with a higher striking price is purchased and one with a lower striking price is sold, both options having the same expiration date.

This spread is sometimes more broadly categorized as a “vertical spread”: a family of spreads involving options of the same stock, same expiration month, but different strike prices. They can be created with either all calls or all puts, and be bullish or bearish. The bear put spread, as any spread, can be executed as a “package” in one single transaction, not as separate buy and sell transactions. For this bearish vertical spread, a bid and offer for the whole package can be requested through your brokerage firm from an exchange where the options are listed and traded.

Risk & Reward

Maximum Loss: Limited to the net amount paid for the spread. I.e. the premium paid for the long position less the premium received for the short position.

Maximum Gain: Limited to the difference between the two strike prices minus the net paid for the position.

Characteristics

When to use: When you are bearish on market direction.

A Put Bear Spread has the same payoff as the Call Bear Spread as both strategies hope for a decrease in market prices. The choice as to which spread to use, however, comes down to risk/reward.

A good tip is to compare the market prices of both spreads to determine which has the better payoff for you.