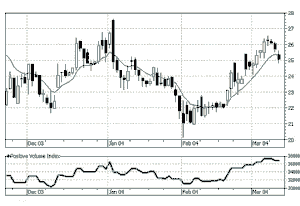

The Positive Volume Index was introduced by Norman Fosback and is often used in conjunction with Negative Volume Index to identify bull and bear markets.The positive volume index (PVI) is an indicator which tracks volume as it increases from the previous day

Postive Volume Index Formula

If the current volume is greater than the previous day, then the formula for the PVI is as follows:

PVI = Previous PVI + ((Close – Previous Close)/Previous Close) * Previous PVI))

Conversely, if the current day’s volume is less than the previous day’s volume, then the formula for Positive Volume Index is as:

PVI = Previous PVI

The Positive Volume Index is based on rhe theory that informed investors are trading on days of lower volume, while the uninformed crowd is participating on days of higher volume. Therefore, the index only includes changes in price when the volume is increasing. These changes are added to the value of the index from the previous day.

This is similar in logic to the Negative Volume Index, which tracks changes on lower volume days. However, where that indicator follows the “smart money”, this The Positive Volume Index follows the “crowd”. This does not mean that they are opposing values, simply that they theoretically track different segments of the trading public.

Since this is a cumulative indicator, the value at the beginning of the data series is zero and the value associated with each new day is added to the value of the previous day.