A long straddle involves going long, i.e., purchasing, both a call option and a put option on some stock, interest rate, index or other underlying. The two options are bought at the same strike price and expire at the same time. The owner of a long straddle makes a profit if the underlying price moves a long way from the strike price, either above or below. Thus, an investor may take a long straddle position if he thinks the market is highly volatile, but does not know in which direction it is going to move. This position is a limited risk, since the most a purchaser may lose is the cost of both options. At the same time, there is unlimited profit potential.

Risk: Limited, but this is not a low-risk strategy because a Straddle is normally expensive to buy and both options are wasting assets.

Reward: Unlimited

When to use: You believe that a stock is about to make a large move in either direction. A good time to utilise straddles is where there has been a prolonged period of extreme quietness (in prices) and implied volatility is around multiyear lows.

If this is the case look to do longer dated months rather than the shorter ones.

Volatility expectation: Very bullish. Volatility increases improve the position substantially. However if a straddle is bought when volatilty is high it’s tough to make a profit.

Profit: Unlimited if stock prices rise but semi-unlimited if stock prices decline as a stock cannot trade less than zero.

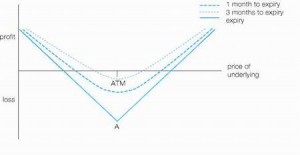

Loss: Limited to the premium paid in establishing the position. Loss will be greatest if the underlying is at the initiated strike at expiry.

Breakeven: Reached if the underlying rises or falls from option strikes by the same amount as the premium cost of establishing the position.

Time decay: Hurts a lot, remember you have double time erosion because of the two options bought. Decay depends a lot on volatility if volatility increases time decay will decrease.