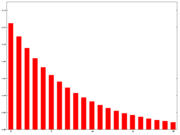

An exponential moving average (EMA), sometimes also called an exponentially weighted moving average (EWMA), applies weighting factors which decrease exponentially. The weighting for each older data point decreases exponentially, giving much more importance to recent observations while still not discarding older observations entirely. The graph at right shows an example of the weight decrease.

An exponential (or exponentially weighted) moving average is calculated by applying a percentage of today’s closing price to yesterday’s moving average value.

The method used to calculate an exponential moving average puts more weight toward recent data and less weight toward past data than does the simple moving average method. This method is often called exponentially weighted.

It’s rather important to know that a 5-day exponential moving average usually consists of over 5 days worth of data and can comprise data from all the life of a futures contract. So such moving averages can be more successfully searched by their actual “smoothing constants,” as the number of days of data in the computation remains equal for the 5-day average as for the 10-day average. Exponential calculations are held at various moving average values depending on the point you start with.