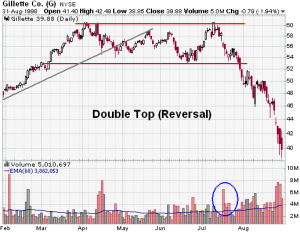

A term used in technical analysis to describe the rise of a stock, a drop, another rise to the same level as the original rise, and finally another drop.The double top is a major reversal pattern that forms after an extended uptrend. As its name implies, the pattern is made up of two consecutive peaks that are roughly equal, with a moderate trough in-between.

The double top looks like the letter “M”. The twice touched high is considered a resistance level.

Although there are chances of variations, the classic double top marks at least an intermediate change, if not long-term change, in trend from bullish to bearish. Many potential double tops can form along the way up, but until key support is broken, a reversal cannot be confirmed. To help clarify the basic facts , we will look at the key points in the formation

1.

Prior Trend: With any reversal pattern, there must be an existing trend to reverse. In the case of the double top, a significant uptrend of several months should be in place.

2.

First Peak: The first peak should mark the highest point of the current trend. As such, the first peak is fairly normal and the uptrend is not in jeopardy (or in question) at this time.

3.

Trough: After the first peak, a decline takes place that typically ranges from 10 to 20%. Volume on the decline from the first peak is usually inconsequential. The lows are sometimes rounded or drawn out a bit, which can be a sign of tepid demand.

4.

Second Peak: The advance off the lows usually occurs with low volume and meets resistance from the previous high. Resistance from the previous high should be expected. Even after meeting resistance, only the possibility of a double top exists. The pattern still needs to be confirmed. The time period between peaks can vary from a few weeks to many months, with the norm being 1-3 months. While exact peaks are preferable, there is some leeway. Usually a peak within 3% of the previous high is adequate.

5.

Decline from Peak: The subsequent decline from the second peak should witness an expansion in volume and/or an accelerated descent, perhaps marked with a gap or two. Such a decline shows that the forces of demand are weaker than supply and a support test is imminent.

6.

Support Break: Even after trading down to support, the double top and trend reversal are still not complete. Breaking support from the lowest point between the peaks completes the double top. This too should occur with an increase in volume and/or an accelerated descent.

7.

Support Turned Resistance: Broken support becomes potential resistance and there is sometimes a test of this newfound resistance level with a reaction rally. Such a test can offer a second chance to exit a position or initiate a short.

8.

Price Target: The distance from support break to peak can be subtracted from the support break for a price target. This would infer that the bigger the formation is, the larger the potential decline.

While the double top formation seems straightforward, technicians should take proper steps to avoid deceptive double tops. The peaks should be separated by about a month. If the peaks are too close, they could just represent normal resistance rather than a lasting change in the supply/demand picture. Ensure that the low between the peaks declines at least 10%. Declines less than 10% may not be indicative of a significant increase in selling pressure. After the decline, analyze the trough for clues on the strength of demand. If the trough drags on a bit and has trouble moving back up, demand could be drying up. When the security does advance, look for a contraction in volume as a further indication of weakening demand.