Further calculation of the True range is necessary to calculate the Directional Indicators (+DI and -DI). The true range is always positive. It is defined as the current highest value of the difference among today’s highest price minus today’s lowest price; today’s highest price minus yesterday’s closing price; and today’s lowest price minus yesterday’s closing price. Wilder, the developer of DMI used a constant value of 14 on daily data. His logic for using this value is that it represented an average half-cycle period. When this task is accomplished for the specified interval, you compute the average value of PDI, MDI, and TRUE_RANGE.

The Plus Directional Movement is now calculated. The sum of the +DI over the observation period is divided by the sum of the True Range over the same period. The calculation of the -DI is analogous. The Directional Movement Index (DI) is calculated by dividing the difference between the +DI and -DI by the sum of both figures. The result is a percentage, with which the extent and/or intensity or the trend is quantified. By smoothing this DI, an Average Directional Index (ADX) results.

Important points :

High: The Symbol field on which the study will be calculated. The application uses the Aspect “High”.

Low: The Symbol field on which the study will be calculated. The application uses the Aspect “Low”.

Close: The Symbol field on which the study will be calculated. The application uses the Aspect “Close”.

Period: The number of bars in a chart. If the chart displays daily data, then period denotes days; in weekly charts, the period will stand for weeks, and so on. The application uses a default of 14.

The Application :

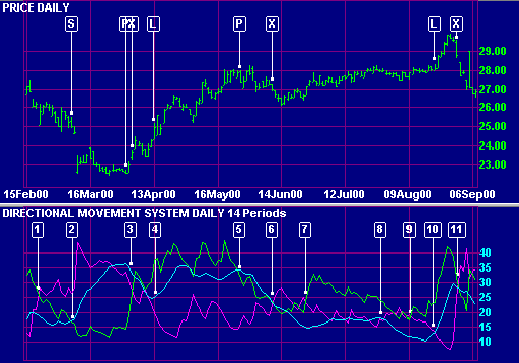

The DI, Directional Movement Index, is a trend following system. The Average Directional Index, or ADX, determines the market trend. When used with the up and down directional study values, +DI and -DI, the DI is an exact trading system.

The rules for using the DI are pretty simple. You establish a long position whenever the +DI crosses above the -DI. You reverse that position, liquidate the long position and establish a short position, when the -DI crosses above the +DI.

In addition to the crossover rules, you must also follow the extreme point rule. When a crossover occurs, use the extreme price as the reverse point. For a short position, use the high made during the trading interval of the crossover. Conversely, reverse a long position using the low made during the trading interval of the crossover.

You maintain the reverse point, the high or low, as your market entry or exit price, even if the +DI and the -DI remain crossed for several trading intervals. This is supposed to keep you from getting whipsawed in the market.